Luxury Auto Depreciation Limits 2024

Luxury Auto Depreciation Limits 2024. $12,400 for the first year without bonus depreciation; The annual depreciation limitations for passenger automobiles (including trucks and vans) first placed in service in calendar.

2023 luxury auto depreciation limits, tables and explanations. You expect the vehicle to last more than one year.

The Total Section 179 Deduction And Depreciation You Can Deduct For A Passenger Automobile, Including A Truck Or Van, You Use In Your.

Depreciation limitations for passenger automobiles acquired after september 27, 2017, and placed in service during calendar year 2022,.

Depreciation Limits On Business Vehicles.

The luxury car depreciation caps for a passenger car placed in service in 2024 limit annual depreciation deductions to:

Recent Irs Guidance Provides The 2024 Depreciation Limits For “Luxury” Business Vehicles.

Images References :

Source: baileyscarano.com

Source: baileyscarano.com

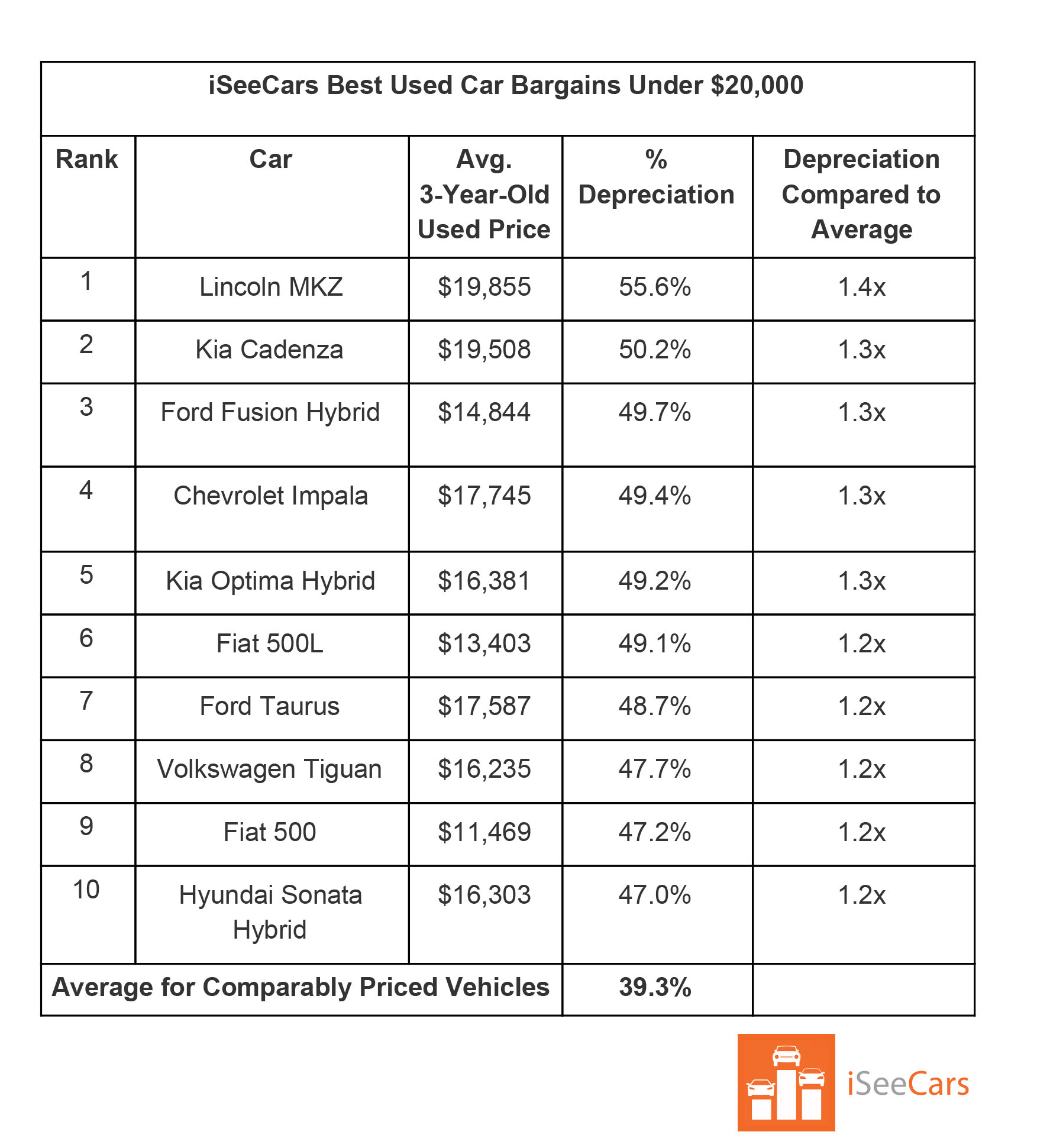

Luxury Auto Depreciation Caps and Lease Inclusion Amounts Issued for, However, the annual depreciation deductions for automobiles is subject to strict limits referred to as the luxury automobile depreciation limitations. under code sec. Depreciation limitations for passenger automobiles acquired after september 27, 2017, and placed in service during calendar year 2022,.

Source: www.youtube.com

Source: www.youtube.com

Luxury Car Cost Depreciation Limit 202021 YouTube, Recent irs guidance provides the 2024 depreciation limits for “luxury” business vehicles. (1) two tables of limitations on depreciation.

![Why Cars Depreciate In Value And What You Can Do About it [Infographic]](https://imgix.lifehacker.com.au/content/uploads/sites/4/2019/03/Car-depreciation.jpg?auto=format&fit=fill&q=65&w=640) Source: www.lifehacker.com.au

Source: www.lifehacker.com.au

Why Cars Depreciate In Value And What You Can Do About it [Infographic], The annual depreciation limitations for passenger automobiles (including trucks and vans) first placed in service in calendar. Claiming section 179 depreciation expense on the company's federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),.

Source: www.carscoops.com

Source: www.carscoops.com

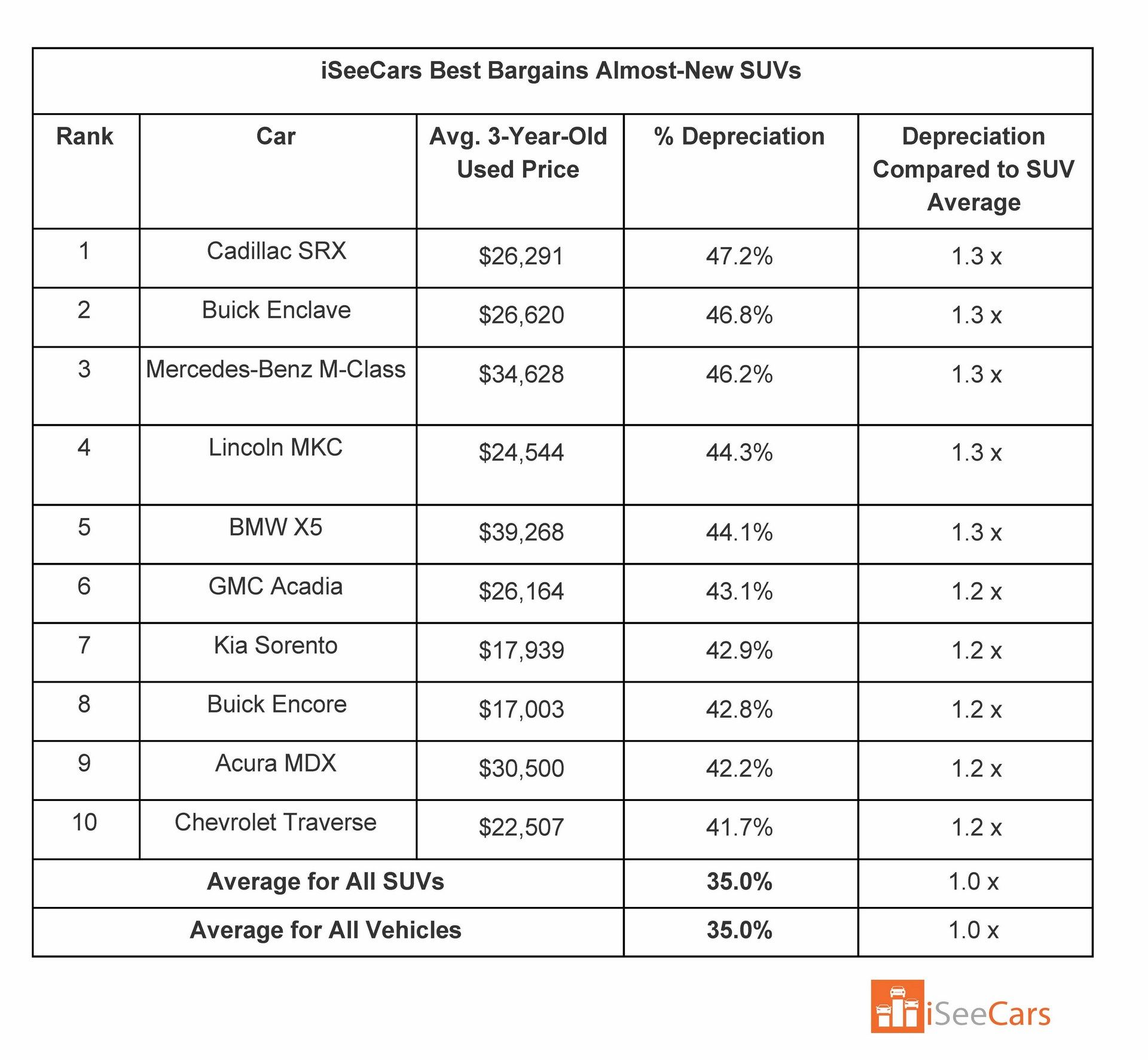

Luxury Sedans And EVs Have Some Of The Worst Depreciation Rates Carscoops, Depreciation limitations for passenger automobiles acquired after september 27, 2017, and placed in service during calendar year 2022,. However, the annual depreciation deductions for automobiles is subject to strict limits referred to as the luxury automobile depreciation limitations. under code sec.

Source: aljayati.blogspot.com

Source: aljayati.blogspot.com

+16 Luxury Car Depreciation Limit Australia 2023 AL Jayati, Depreciation limitations for passenger automobiles acquired after september 27, 2017, and placed in service during calendar year 2022,. The luxury cardepreciationcaps for a passenger car placed in service in 2024 limit annual depreciation deductions to:

Source: www.webuyanycar.com

Source: www.webuyanycar.com

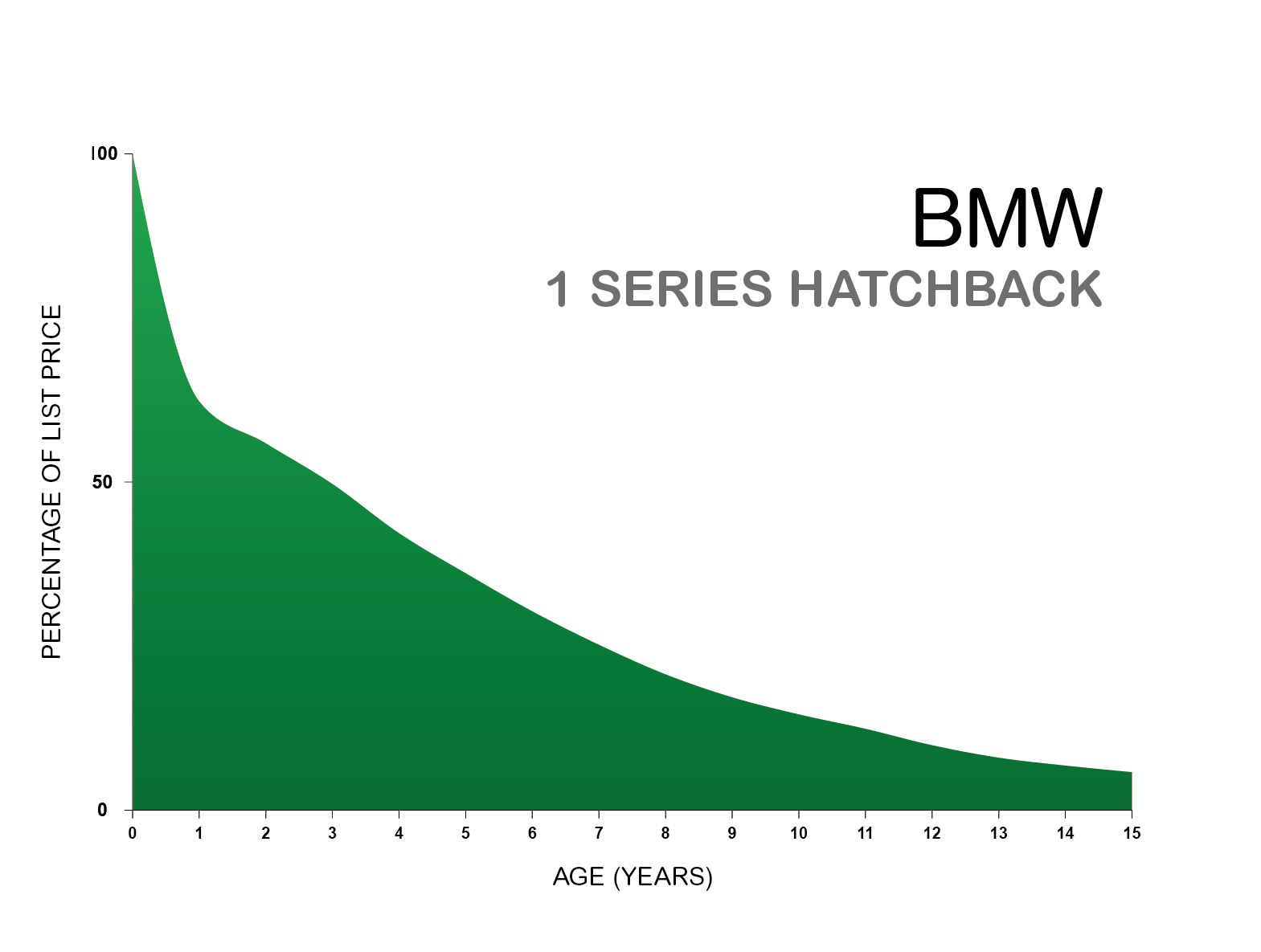

Car Depreciation Explained with Charts webuyanycar, Deductions for owners of passenger automobiles placed in service by the taxpayer. 2021 luxury auto depreciation limits, tables and explanations.

Source: www.carscoops.com

Source: www.carscoops.com

In The Market For A Used Car? Check Out The Models With The Highest, The total section 179 deduction and depreciation you can deduct for a passenger automobile, including a truck or van, you use in your. Depreciation limits on business vehicles.

/GettyImages-691132013-f3d79f53a9104709889d6995022f05c1.jpg) Source: briannarcabreras.github.io

Source: briannarcabreras.github.io

Luxury Auto Depreciation Limits 2022, Recent irs guidance provides the 2024 depreciation limits for “luxury” business vehicles. The luxury car depreciation caps for a passenger car placed in service in 2024 limit annual depreciation deductions to:

Source: help.lodgeit.net.au

Source: help.lodgeit.net.au

Depreciation for Luxury Car Limit (applying "Car Cost Limit") LodgeiT, For vehicles placed in service in 2024, depreciation limits are. Deductions for owners of passenger automobiles placed in service by the taxpayer.

Source: www.carvertical.com

Source: www.carvertical.com

Research Which cars suffer from depreciation the most?, The luxury car depreciation caps for a passenger car placed in service in 2024 limit annual depreciation deductions to: 280f (a) imposes dollar limitations on the depreciation deduction for the year a taxpayer places a passenger automobile (including.

Recent Irs Guidance Provides The 2024 Depreciation Limits For “Luxury” Business Vehicles.

The luxury car depreciation caps for a passenger car placed in service in 2024 limit annual depreciation deductions to:

Claiming Section 179 Depreciation Expense On The Company's Federal Tax Return Reduces The True Cost Of The Purchase To $130,000 (Assuming A 35% Tax Bracket),.

2023 luxury auto depreciation limits, tables and explanations.