Working Holiday Tax Rate 2024

Working Holiday Tax Rate 2024. For a working holiday maker, the tax rates to be applied depends on their taxable income earnt within a single financial year e.g. If you’re on a working holiday in australia, you’ll be expected to pay tax on any earnings.

Excerpts from finance bill 2024: (1) you are a working holiday maker if you have a visa subclass:

Working Holiday Tax Rate 2024 Images References :

Source: oneclicklife.com.au

Source: oneclicklife.com.au

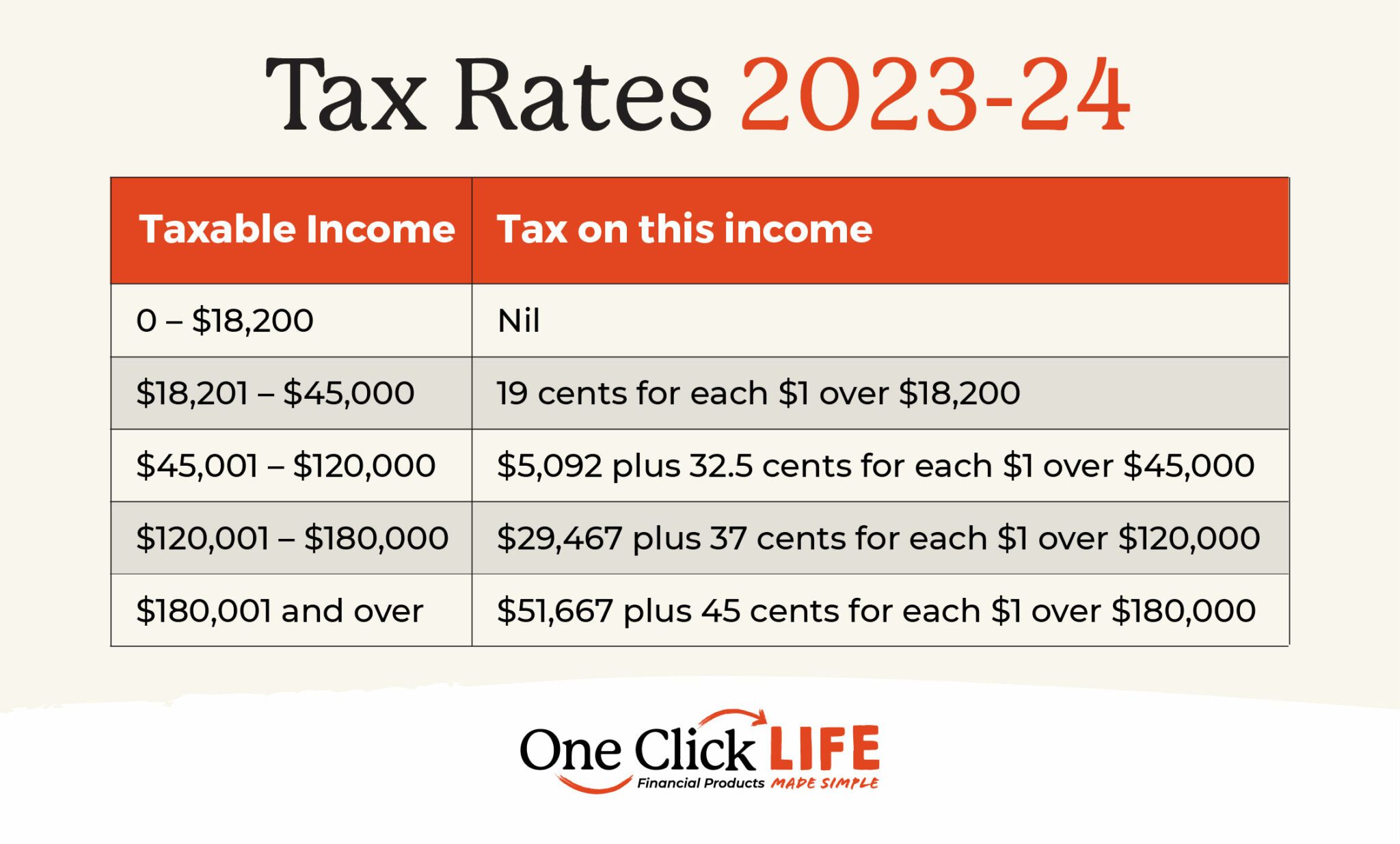

2024 Tax Brackets One Click Life, The last date for filing income tax return (itr) is.

Source: www.lightningpayroll.com.au

Source: www.lightningpayroll.com.au

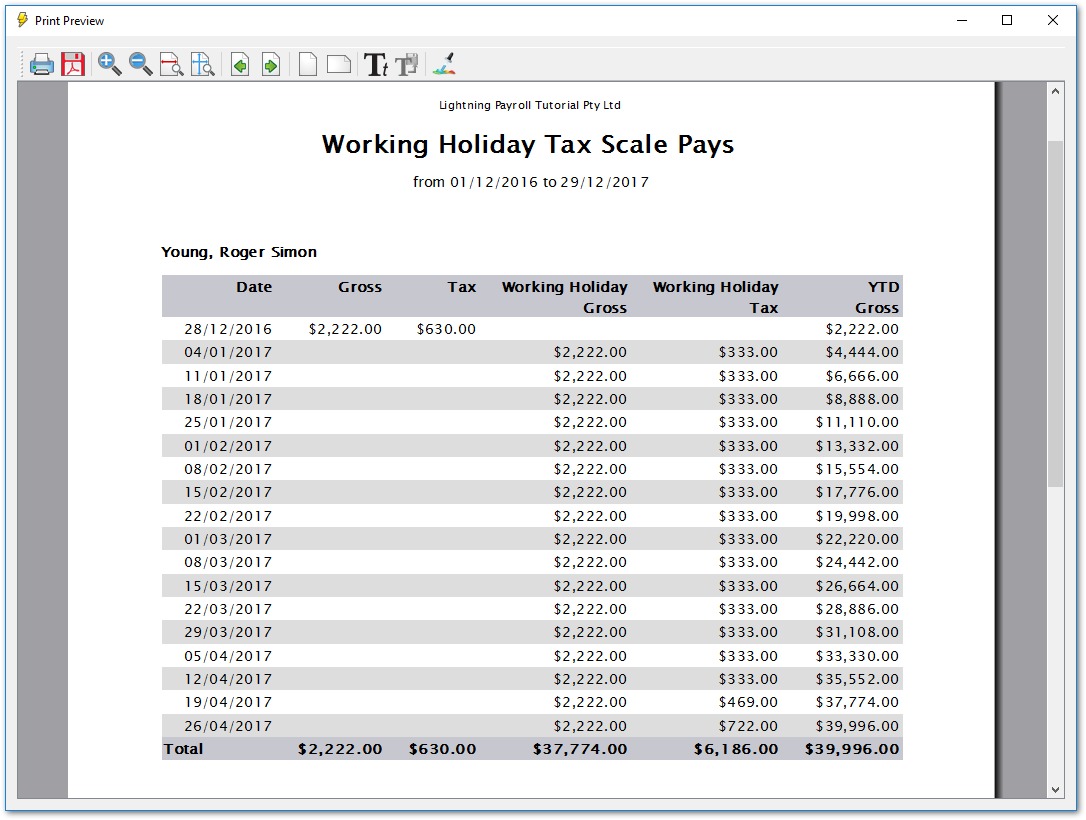

How Do I Set Up Tax for Employees on a Working Holiday? LP, Calculate your working holiday visa tax refund.

Source: albertaotrudi.pages.dev

Source: albertaotrudi.pages.dev

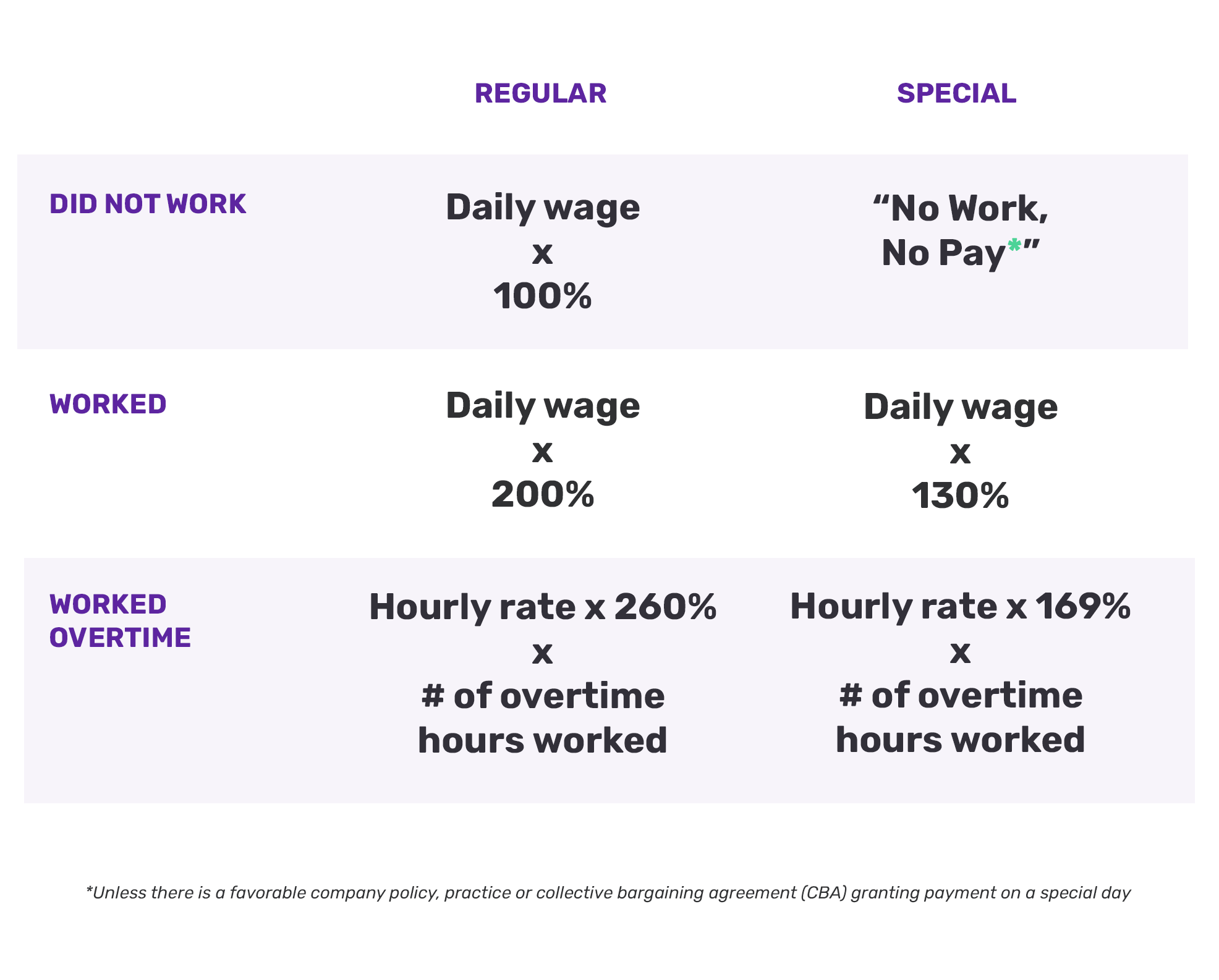

Bank Holidays 2024 And 2025 Willy Julietta, This follows the recent decision by the high court in the matter of addy v commissioner of taxation.

Source: www.youtube.com

Source: www.youtube.com

working holiday tax introduction YouTube, 25 jul 2024, 08:27:15 am ist income tax budget 2024 live:

Source: taxleopard.com.au

Source: taxleopard.com.au

Australian Working Holiday Maker Tax Rates 2024 TaxLeopard, Claim your australia working holiday visa backpacker tax back from the australian government.

Source: wanetawashlee-c0c.pages.dev

Source: wanetawashlee-c0c.pages.dev

How Many Working Days In 2024 Philippines Imogen Karrie, You’ll pay a different rate of tax depending.

Source: payruler.com

Source: payruler.com

Are you getting the right holiday pay? Payruler, When you start working in.

Source: jhontax.co

Source: jhontax.co

Mengenal Kebijakan Tax Holiday dan Tax Allowance, Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

Source: gettingdownunder.com

Source: gettingdownunder.com

Working Holiday Visa Tax All Your Questions Answer, Make sure that your employer is registering you as a working holiday visa maker otherwise you will be taxed 32.5% (foreign resident rate).

Source: handsoffsalestax.com

Source: handsoffsalestax.com

When are the 2024 sales tax holidays? Hands Off Sales Tax, You are a working holiday maker if you have a visa subclass:

Posted in 2024